New Directors – 1989 to 1998

Under New Leadership

Within GraceKennedy & Co., Ltd. there was no doubt about the line of succession. Wisely, after having three years previously announced his impending retirement, Carlton Alexander had moved to find agreement on the choice of the next Chief Executive Officer.

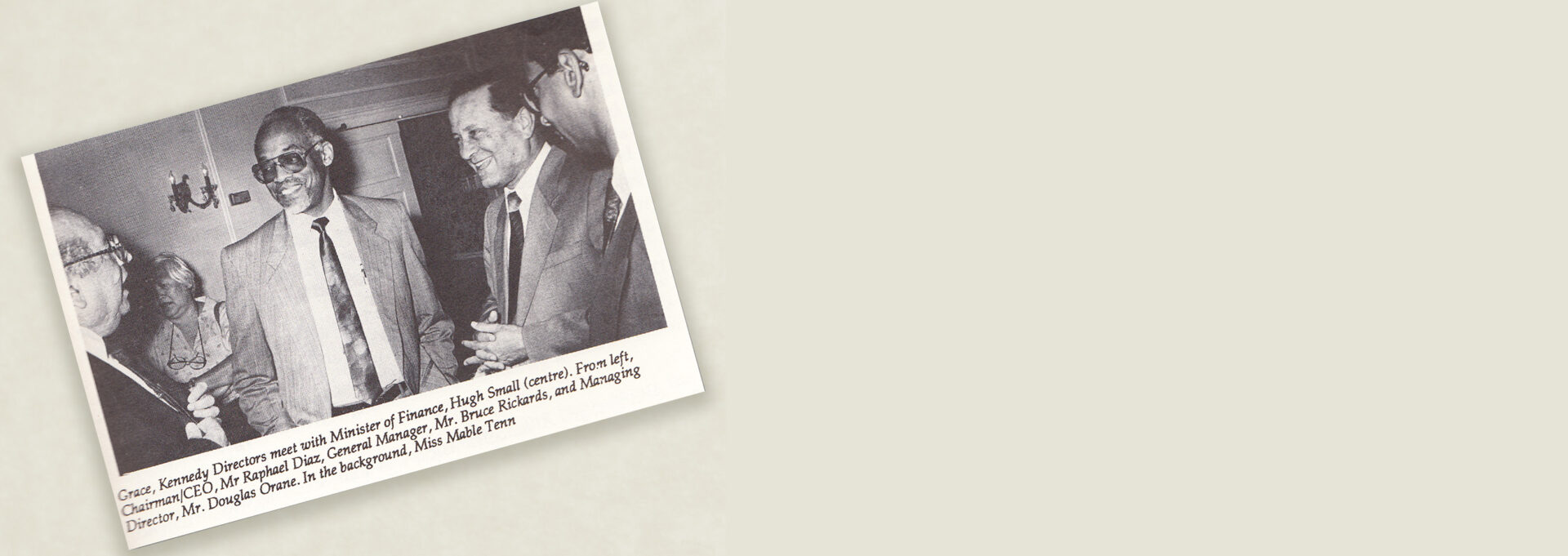

Two days after his death, the Board met. As was usual in the absence of Alexander, Rafael Diaz took the chair. Carlton’s death was sadly noted and funeral arrangements discussed. Then, unanimously, Rafael Diaz was appointed Chairman and Chief Executive Officer. His place as Finance Director was, again with unanimous approval, filled by Peter Moss-Solomon.

Beyond the Boardroom, and in the wider society, there was inevitable concern. Who, if anyone, could follow in Carlton Alexander’s footsteps? Rafael Diaz, in accepting the appointment, displayed his absolute self-confidence – not only in his qualification to succeed, but also in his commitment to add another wing to the already sprawling mansion of GraceKennedy & Co., Ltd.

Rafael Diaz joined GraceKennedy in 1969 as an accountant and became Financial Controller in 1974. Two years later, as Finance Director, he was a member of the Board of Directors becoming Deputy Chairman in 1980. When Rafael Diaz succeeded Carlton Alexander, the Grace Group had an annual turnover of over $1.5 billion. There were 1,632 shareholders in the holding Company with 76 subsidiaries and associated companies employing nearly 2,000 permanent and 500 seasonal workers. The Company operated in six countries; Jamaica, Belize, Trinidad, Canada (Montreal, with B. Terfloth, and Toronto), the United Kingdom (with Terfloth), and the United States (Atlanta with Terfloth), and Miami. It was recognized, as Dr. Dudley Stokes put it in the Gleaner of October 1, 1989:

…. as one of the country’s best run businesses, with a sound management structure, a strong corporate image, and a relatively well paid work force of nearly 2,000.

And when asked what advice he would most like to give the Government, Diaz replied:

What really is required is to earn more foreign exchange. My advice to the Government, therefore, is to focus on an export-led economy.

This was the view of the new Chief Executive Officer of a traditional importing-distributing business.

Rafael Diaz had long been an advocate of a greater export business. His first consideration was the earning of foreign exchange to meet even a fraction of the Company’s huge overseas financial commitments. Through the years, however, that concern had grown. There had emerged the concept of another dimension of the interests of the Company through the building of an Export Department and the first tentative essays into overseas trade. GraceKennedy & Co., Ltd., Importers and Distributors, might also be GraceKennedy & Co., Trading Company Ltd. Diaz had support within the Company and now, in 1989, GraceKennedy & Co., Ltd. was reunited with Terfloth & Co., Ltd., World Trader. No better time to set the sights.

Nor were the new leadership in the Company and the re-association with the Terfloth enterprise the only new features in the Jamaican business world. By 1990 there was a national change which seemed likely to affect that world: a new Government. On the advent of national elections in 1989 the possibility of a return to power by the People’s National Party seemed to raise economic rather than political apprehension. In the view of one member of the GraceKennedy Board, the major risk from a PNP Government would be the return of corned beef and canned mackerel imports to the Jamaica Commodity Trading Company. Since his overturn by the Jamaica Labour Party in 1980, Michael Manley had proclaimed his previous misjudgments. Moreover, still recognized by the population at large as ‘one who love poor brethren’, his election slogan of ‘We Put People First’ raised hopes among the mass of small consumers in days of wild ‘consumerism’.

Resuming Growth

In May 1989, GraceKennedy & Co., Ltd. undertook to sign a management contract with Lipton (Jamaica) Ltd., and also agreed to a 22.5 per cent shareholding in a large broiler- fowl operation, Goldcrest Farms Ltd., in which Seprod would be the major shareholder with 45 per cent of the equity and the Management Contract. The market for broiler meat was estimated at 124 million pounds a year. It was anticipated that profits would begin in the third year of production.

Also in May, the Company acquired the 51 per cent shareholding of Ernest Viera & Co., Ltd., partners in Viera & GraceKennedy International Ltd. in Trinidad. With the approval of the Government of Trinidad, that company now became a wholly owned subsidiary. Robert McDonald was appointed General Manager of GraceKennedy Export Trading Ltd., responsible also for operations in Trinidad, Belize and Ontario. In Miami (Atlantic & Pacific Trading Co., Ltd.) Nick Bogle was to be resident representative. These were the administrative beginnings directed towards Rafael Diaz’s ultimate aim.

In September 1990, a Barbadian survey showed GraceKennedy & Co., Ltd. as the largest of the Caribbean’s listed companies when ranked by volume of sales during 1989. It was, not, however near the top ranking in terms of market value. In that, the Company ranked seventh out of ten listed, coming behind one Barbadian, one Trinidadian and four Jamaican concerns.

In June 1991, for the tenth time in all and the fifth in a row, GraceKennedy won the Jamaica Manufacturers’ Association Award ‘For the most outstanding performance as Trader/Exporter’. Exports had gone to CARICOM Countries, Bahamas, Bermuda, The Virgin Islands, Cayman, Nigeria, Germany, Italy, the United Kingdom, the United States and Canada. But in thanking all those who had contributed to the success, GraceKennedy acknowledged that the total value of goods exported, though pleasing, was still small – something over $50 million covering a range of about a hundred food and other items.

We thank them and are proud of them. They are making sure that our goal of significantly increasing our export will become a reality!

No overstatement of accomplishment in that.

Very soon after taking office, Rafael Diaz called his Board of Directors into conference in Ocho-Rios.

Managerial responsibilities and the Corporate Structure were revised. As Chairman and Chief Executive Officer, Diaz would oversee all operations with a special watch on International Trading. There would be four Core Divisions in the new organizational structure.

Rafael Diaz would oversee International Trading, Robert McDonald would become Manager of Overseas Operators and Cecil Ho would take over the Export Trading Company. Douglas Orane, Group Managing Director, would be responsible for the Trading Division.

The Trading Division consisted of the following companies:

- GraceKennedy & Co., Ltd.(Merchandise)

- GraceKennedy Export Trading Ltd.

- Grace Food Processors Ltd.

- Grace Food Processors (Canning) Ltd.

- National Processors Ltd.

- Agro-Grace Ltd.

- United Agricultural Produce Traders Ltd.

- Dairy Industries (JA) Ltd.

- Challenge Enterprises Ltd.

- Lipton (JA) Ltd.

- Hi-Food Stores (JA) Ltd.

- Domestic Sales Ltd.

- Hardware Bulk Purchasers Ltd.

- Rapid Sheffield Co., Ltd. (to be responsible for Armour Metal Ltd.)

- Armour Metal Fencing Ltd.

- Armour Block & Construction Ltd.

- Pilkington Glass (JA) Ltd.

- Caribbean Greetings Corp. Ltd.

- Versair In-Flite Services Ltd.

- Gracekennedy Properties Ltd.

- Kingston Properties Ltd.

- Caribbean Basin Electronics Ltd.

- Caribbean Agricultural Trading Co., Ltd.

- GraceKennedy (Belize) Ltd.

- GraceKennedy Ltd. (T&T)

- GraceKennedy (Barbados) Ltd.

- GraceKennedy (Carib) Ltd.

- GraceKennedy (Ontario) Inc.

Captain M. Belcher together with Francis Kennedy, Ernest Girod, and George Phillip, would be responsible for the Transportation Division:

- GraceKennedy & Co. (Shipping) Ltd.

- International Shipping Ltd.

- Carib Star Shipping Ltd.

- Universal Freight Handlers Ltd.

- Terminal Services Ltd.

- Kingston Terminal Operators Ltd.

- Port Services Ltd.

- Kingston Wharves Ltd.

- Harbour Cold Stores Ltd.

- Equipment Care Ltd.

- H. Macaulay Orrett Ltd.

Peter Moss-Solomon would be in charge of Group Finances, and Paul Bitter would be responsible for the Financial Services Division which would include:

- GraceKennedy & Co. Ltd (Investment Division)

- Allied Insurance Brokers Ltd.

- Jamaica International Insurance Co. Ltd.

- H. Macaulay Orrett (Ins.) Ltd.

- George & Branday Ltd.

- Vortex Ltd.

- GraceKennedy Travel Ltd.

In addition Anthony Barnes would be responsible for the Information Division: Grace-UNISYS (JA) Ltd.; WTG Systems Ltd.

The Divisions, which appeared to have the greatest potential for rapid and immediate growth, were Financial Services and Transportation.

Following the October retreat of the Board of Directors, there was a much larger gathering of about 180 GraceKennedy managers, local and overseas, on January 6, 1990. Budgets were presented, discussed and reviewed. Suggestions for improving performance were made. Finance Director, Peter Moss-Solomon, spoke of the need for skilful management in the face of restricted credit and high interest rates. Representatives of the Terfloth Companies, including Boerries Terfloth, spoke of the work of the international trader and emphasized:

…. to be successful in exporting, one must be constantly aware of the characteristics of, as well as the differences between, local and international markets.

The world-trader had to watch and anticipate events and opportunities:

What significance does the collapse of Communism in Eastern Europe have for the Jamaican Exporter? …. What are the possible implications for international trade of the reunification of Germany?

The world is wide, but quick thought and action are imperative, for modern electronic information technology has made it small.

In late 1989, Rapid Sheffield Co. Ltd. had bought Carib Hardware, on Slipe Road. At the January 1980 review of performances in the previous year, the new acquisition was reported to be doing fairly good business. So, too, were most other companies in the group, but budgeted performance had not always been achieved. WTG Systems, free of its subsidiaries (such as Data Services Ltd.) which were to be wound up, had performed in excess of budgeted profit. Of the other newer acquisitions, however, Challenge Enterprises Ltd. and Hi-Lo Supermarkets were losing money.

Rafael Diaz was concerned about the lower than budgeted profit for the year:

The Group Profit statement…. showed that our high dependency on bank loans plus overdraft has affected our profit performance, and we seem to be borrowing more and more.

He called for better management of inventory and Accounts Receivable.

In July 1990, Domestic Sales Ltd. ceased to be a joint venture between Unilever (U.K.) and GraceKennedy & Co., Ltd. Henceforth, the latter would be Unilever’s principal agent.

The market remained tight. Later in the year, Bruce Rickards, who had been appointed Marketing Director for the Grace Brand, went visiting customers, in company with other Directors and Managers, in Mandeville, Montego Bay, and Ocho Rios as well as Kingston. They discussed Grace products and other existing and new brand products such as Blue Band Margarine, the appearance of which, in June, had been much advertised in the press.

The visits had been necessary. ‘Aggressive’ was an apt word for the times. As new outlets opened, the supermarket business became increasingly competitive. The Financial Gleaner of April 27, 1990, had highlighted the situation in Kingston and lower St. Andrew:

As supermarkets in the Corporate Area struggle to maintain their share of a declining market, the boundaries of their competition have been expanded.

The Financial Gleaner understands that the opening of Sovereign Supermarket in Liguanea in April 1989 has caused up to 30 per cent reduction in the sales of several supermarkets – one as far away as on Red Hills Road.

However, the real ‘bad blood’ within the retail market began to spill when Sovereign decided to open its doors to shoppers on Sundays. Sunday shopping became an immediate hit at Sovereign, and started to affect the sales of Hi-Lo and Allied chains…. and others.

There was no help forthcoming from Government in attempts to stop Sunday opening. In consequence, others followed suit. James Moss-Solomon, in charge of the Hi-Lo chain, was quoted as saying:

The distributors are going to have to find products that sell.

Supermarkets can no longer afford to put out goods just to take up shelf space….and he noted a shift in demand away from ‘semi-luxury’ commodities. Another supermarket operator put the basic situation succinctly. He said:

In the seventies, people used to shop every day because of the shortage of goods. Today they do the same because of the shortage of money.

The visiting GraceKennedy Team would have had much to discuss with their customers. Among other things, they emphasized that henceforth a thirty-day credit policy would be ‘strictly enforced’.

Government, too, was feeling the crunch. Starting October 24 1990, the Bank of Jamaica began to purchase 30 per cent of the foreign exchange taken by the commercial banks. At the same time, the flow of foreign exchange into the banks was far less than the bankers had predicted. There would, consequently, be added difficulties in the way of settling foreign debt. GraceKennedy & Co., Ltd., for example, through Dairy Industries Ltd.,

were facing an increasing impatience on the part of the New Zealand Dairy Board to which they owed a considerable sum. And there were others.

Not surprisingly, since shipping provided a source of, rather than a drain on, foreign exchange, GraceKennedy & Co., Ltd. entered into two joint ventures in October 1990; the Arawak Caribbean Line, to provide a liner service between South Florida and Kingston; and GraceKennedy Shipping (USA) Inc. between Kingston and Miami. There was a projected earning of US $1.8 million net in the first year. It would be necessary, however, to provide office-space for each in Miami and to transfer staff there from GraceKennedy & Co. (Shipping) Ltd.

Earlier, in August, against boosting one of the more profitable of the Group’s Divisions, GraceKennedy & Co., Ltd. had launched, with much fanfare, the Grace Financial Force:

- Allied Insurance Brokers (Gladstone Ford)

- Jamaica International Insurance (Brian Bitter)

- George & Branday Ltd. (Clive Edwards)

- GraceKennedy Travel Ltd. (Christopher Chin)

- Grace Properties Ltd. (Calvin Moo Young).

It was announced:

We stand together as a new force in the world of business and finance in Jamaica today. Individually we have built impeccable reputations for professionalism, integrity and efficiency. Now, these are combined to give a foundation of unmatched strength to the service of each separate organization.

The Financial Force would be headed by Paul Bitter, Divisional Director.

At the start of the same month, GraceKennedy had put out an Agricultural Supplement to the Daily Gleaner. The GraceKennedy August 1 (Emancipation Day) Supplement would become a regular feature. This one advertised the activities of farmers producing crops; the Grace factories and supermarkets to which the crops went; Grace Kitchens which demonstrated their uses; Agro-Grace which supported the farmers; and Versair In- Flite Services which fed some of the final products to air-passengers.

The Supplement also carried a report of an interview with two representatives of the Ministry of Agriculture; Mr. Hopeton Fraser, Director of Marketing, and Mr. Lennie Morgan, Marketing Extension Officer. The difficulties of organizing production and distribution were outlined. Mr. Fraser said ‘Our greatest need, is for a central organization – or organizations – to buy from contract farmers’. GraceKennedy was already so engaged and would go much further. But Fraser mentioned two further problems about which the Company could do nothing. One was ‘the competition from illicit importation of food’. The Company was well aware of that one. The other, prevailing in most of the areas occupied by small and middling producers of vegetable crops, was ‘…. seasonal production, since most of our crops are rain-fed. Again, this gives us a situation of glut and scarcity.’

The comment coincided with a glut of tomatoes and other crops in St. Elizabeth. Douglas Orane, Mable Tenn, Michelle Wong (Manager of the Hi-Lo Supermarkets), Gladstone Rose (Grace Food Processors (Canning) Ltd.), Pansy Edwards (That Company’s

Agronomist), and a representative from the Ministry of Agriculture had all rushed into the parish. GraceKennedy had helped by taking much of the wasting produce. The Hi- Lo stores had been able to offer tomatoes at fifty cents a pound – a good move in view of the competition – but good business cannot be built on gluts.

Mable Tenn, recently appointed to be Vice-Chairman of the Government’s newly-named Rural Agricultural Development Authority (and the title itself said something, for might it not have been an ‘Agency’?) was given special recognition for her long association with GraceKennedy & Co., Ltd, and her unwaning enthusiasm in agricultural endeavour.

The year 1990 ended with problems galore. The foreign exchange situation was critical. The Jamaica Commodity Trading Company (formerly Nutrition Holdings, then the State Trading Corporation) was under heavy fire. The Gulf War had broken out and prices were escalating further. Within the GraceKennedy Group, National Processors Ltd. phased down operations, except the production of Quench Aid. Armour Metal Fencing Ltd. was in deep trouble and a complete reorganization was being proposed. The joint venture in the production of broiler meat at Goldcrest Farms was in major difficulties which apparently involved ‘…. massive commitments for expenditure the Board was not aware of ….’ Price, Waterhouse, the GraceKennedy auditors, were called in to investigate, and the Chairman of Seprod, the major shareholder, had gone abroad to try to negotiate cancellation of some commitments. Rapid & Sheffield was considering a contingency plan, in the face of severe shortage of supplies of pine lumber, to reduce staff and outlets.

The Jamaica Commodity Trading Company, responsible for the importation of motor vehicles, lumber, and basic foods, was said to be nearly bankrupt with about $800,000,000 owed to it. The International Monetary Fund was pressing for its dissolution. GraceKennedy & Co. Ltd. in agreement with others, was in full support of the proposal. Mr.Horace Clarke, Minister of Agriculture and Commerce, claimed that the JCTC was acting like a banker to Jamaica’s food distributors whom he largely blamed for the JCTC’s distress. The PSOJ charged bad management:

For the JCTC to be owed more than $800 million, regardless of who are the debtors, is prima facie evidence of poor management.

Wherever the blame lay, the Government held out. The JCTC would remain. On the other hand, there were signs, welcomed by the PSOJ, of a policy of deregulation by the Government.

GraceKennedy & Co., Ltd. made another move in the attempt to earn more foreign exchange. At the end of October it was announced that Grace Remittance Services had been established to facilitate transfers of foreign exchange from any outside source directly to Jamaica. The major news, however, was that this new GraceKennedy endeavour was linked to the services of the huge American company, Western Union.

On January 31, 1991, the Board of Directors met, as usual, to consider the past year’s performance and projections for the New Year. Group Profits would be about the same as they had been in 1989. Profits of the local companies had turned out some $17 million less than budgeted. Now, following deregulation of the foreign exchange market, the Company had two sets of foreign exchange arrears: one under the original scheme by which exchange had been acquired from the Bank of Jamaica; another, following deregulation, in various commercial banks.

Anthony Barnes, appointed Deputy Finance Director in charge of procuring and managing foreign exchange, indicated that in 1991 there would probably be a shortfall of US$33 million. Athol Smith and John Issa suggested a number of economizing moves. They were based on the obvious needs. As far as possible, steps should be taken to trim unnecessary expenditures; dispose of idle assets; reduce production of less profitable items; purchase locally instead of abroad; and, if not earn more, certainly try to spend less in foreign currency.

GraceKennedy’s problem reflected the national one, and, in the view of analyst Max Lambie, the national problem was much subscribed to by ‘the complacent corporate titans’ in Jamaica who were voracious and controlling consumers of foreign exchange. In the Sunday Gleaner of June 2, 1991 he set out supporting statistics:

Last year, the total foreign exchange demand of the country was just about satisfied by a supply of US3,100 million. Out of this total: US$1,700 million was demanded by the formal merchandise sector; US$500 million by the informal market; and the Government itself used US$900 million for the payment of foreign debt and for oil importation. But, at present, the best estimate that can be made projects that foreign exchange demand has risen by US450 million to a total of US$3,3350 million for 1990/1991.

GraceKennedy & Co., Ltd. was by no means alone in recording a disappointing year in 1990. A poll carried out by Professor Carl Stone and based on a survey of 232 larger Jamaican Companies, 40 small business enterprises and 62 higglers indicated that the majority had suffered. Of the companies in the survey, 38% had had an increase in profits, 19% (and this would have included GraceKennedy & Co., Ltd.), had remained about the same as in 1989, and 43% had had decreased profits.

In all of this, however, and in particular reference to demand for foreign exchange, it is important to consider also any compensatory earning of foreign exchange. GraceKennedy & Co., Ltd. cannot be faulted for lack of endeavour, and a considerable measure of success in that, at the end of June 1991, the Company’s outstanding foreign payables totalled just under US$13.2 million.

As a contributing factor to the problem, bureaucratic delays, wherever they originated, affected earnings. In early 1991 the business of GraceKennedy’s Export Trading Co. was handicapped by the Bureau of Standards holding for ‘unnecessarily long periods’ products to be approved by them before export to overseas markets. There may have been very good reasons for such delays; but ‘good reasons’ sometimes lead to undesirable consequences. They should, therefore, if possible, be eliminated.

In such hard days of competition, additional responsibility fell on the shoulders of the Company’s sales staff. Douglas Orane paid them a tribute in late January 1991. Special mention was made of Bruce Rickards, the second longest serving staff member, who had given service in Sales and who had great understanding of the qualities necessary in a good salesperson. Outstanding salesmen of the past were named and their particular selling strengths and human weaknesses recalled.

In March, Challenge Enterprises Ltd. was closed. Its acquisition had proven to be a major misjudgment. By agreement, GraceKennedy and Desnoes & Geddes would split the assets in equal shares. In April, apartments on Richings Avenue were sold, but it was noted that other property developments in St. Andrew, on Donhead Avenue and Surbiton Road, should be profitable. The latter, an apartment building soon to be begun would contain units on four floors to be first offered to staff of the Grace Group.

In May and June, as food sales declined, stocks accumulated. In times gone by, 70,000 cases of corned beef would have been sold in two months. Now the sale took six months, and:

The informal commercial importers are serious competitors in canned items such as green peas, corn, and baked beans as their large cans are being sold at the same price as our regular cans, which are smaller.

What was lost on the swings might, in part, be retrieved on the roundabouts. GraceKennedy & Co., Ltd. contracted to produce fruit drinks for Motts of the United States.

The main advances of June, however, were made in the Information Division. The merger of WTG Systems Ltd and APTEC was announced:

The new entity will offer services from writing software, training personnel, and installing software. Together they will have the largest offering of branded hardware in Jamaica.

And Systems Alliance, Jamaica, was launched. This was an alliance between GraceKennedy & Co. Ltd. and Peat Marwick. Rafael Diaz, outlining the advantages to be gained, mentioned in particular ‘the opportunity to access overseas markets using local expertise and talent’ and the expectation of earning foreign exchange by the export of information technology to the Caribbean and beyond.

In August, following discussion by the Board in March, GraceKennedy & Co. Ltd. purchased additional shares to make them the majority fifty-one per cent owner of Kingston Wharves Ltd. Also in August, on the First, Emancipation Day, GraceKennedy’s annual Gleaner Supplement featured the Company’s exports. In Jamaican dollars, sales had increased from just over $20 million in 1985 to more than $50 million in 1990.

On the other side of the coin, the Company, which had begun by importing everything they sold, was now importing only thirty-two per cent. Sixty-eight per cent of what was sold locally was produced locally. Here again, though this was not indicative of an absolute decline in the Company’s annual requirement of foreign exchange, it emphasized the drive towards self-sufficiency. As Rafael Diaz put it: ‘We must become net earners of foreign exchange.’ And the road to this? – ‘Exporting to the World is our Goal’.

In mid-October 1991, Rafael Diaz met representatives of the press. The Gleaner reported:

GraceKennedy and Company Limited now earns one-third of its foreign exchange requirements, with this amount expected to increase to half (50 per cent) by the end of the year.

This is according to Chairman Rafael Diaz, who spoke at a press briefing at the offices of George & Branday in New Kingston yesterday. The Chairman said it was their intention to transfer Grace from a net user to a net earner of foreign exchange in the near future…. As part of the company’s thrust to earn foreign exchange, Grace is moving more into ‘global marketing and international business development’. In this respect, there have been new management appointments and promotions, with Jimmy Moss-Solomon being appointed Director of International Business.

Max Lambie, the inveterate challenger of the big conglomerates proclaimed: ‘In contrast to its competitors, Grace is alive and well’. There had been much speculation, he continued, about the performance of any successor to Carlton Alexander; and, in difficult days, the office had been filled by a man comparatively unknown to the public:

But whatever doubts there might have been about the stewardship of the Company must have quickly evaporated with the publication of the Financial Statement for 1990.

The leadership, and survival strategies, had succeeded; but what of the sights set for the future?

There are problems still. The leaders of the Group speak of continuing scarcity of foreign exchange; of the intense competition still faced by the Merchandise or Trading Division, especially from non-traditional traders and illicit imports; and of the products of the GraceKennedy factories encountering increased competition from imported products entering under the Structural Adjustment Programme.

These are all to be overcome, if possible, by aggressive marketing, good customer service, and independence in foreign exchange requirements. And the strategy? By ‘shift of orientation to World Merchants’.

On Being a World Trader

In the stringent days of 1981, Carlton Alexander asked his fellow Directors to give their views on the Company and on what ought to be done. Rafael Diaz’s recorded comment was:

We must export as we have too many goods, the domestic market is saturated, and there is less disposable income in the hands of the consumer.

It was at that meeting that Alexander wondered if it might not be a good idea to set up an Export Department.

At another meeting of the Board some years later, in 1986, when Ivanhoe Yee was in charge of that Department:

It was recommended to Mr. Yee that to operate in the international market he would have to buy and sell externally also and not sell only domestic goods.

The early interest of GraceKennedy & Company in the development of an export trade arose from the limitations of the local market and the need to earn foreign exchange with which to pay for imports. Those were domestic concerns which could not provide the

motive for world trading. A World Merchant deals in foreign exchange, but is motivated by a desire to engage in international trade because of the attractions, financial and other, which that particular enterprise seems to offer. There is a wide difference between the operations of an importing and distributing company, such as GraceKennedy & Co. Ltd. has traditionally been, and a trading company. It is not unlikely that the advice given to Ivanhoe Yee had originally come from Boerries Terfloth, or from an understanding of the operations of Terfloth & Co. An importer and distributor must know his local market, estimate its needs, bring in the goods and distribute them through various wholesale and retail outlets in the local market. A world trader, in an international market, seeks out suppliers and buyers anywhere and acts as intermediary. There is no ‘local’ market: the marketplace is worldwide. GraceKennedy & Co., Ltd. is therefore doubly fortunate in its partnership with the Terfloth companies. Boerries Terfloth is both an experienced and successful world trader and a trusted associate of long standing.

Trust is the basis of all good business. There were days when the handshake was as binding a pledge as the legally executed document. Whatever criticisms might have been made of Luis Fred Kennedy’s governing directorship of GraceKennedy & Co. Ltd., it was well known that he kept his word. Boerries Terfloth who dealt with him, and not always in perfect amicability, remembers. And in the Terfloth Companies:

While we practice the traditional merchant’s pledge that ‘Our Word is Our Bond’, we also owe ourselves and our trading partners the assurance of signed agreements – properly conceived, prepared and executed.

Moreover, we are cautious of involving ourselves with trading partners who do not subscribe to our policies and principles of integrity and fair dealing.

Good faith is sometimes more important than a line of credit.

The world trader has to look and listen. There can be no complacent assumption of a thorough understanding of all the aspects of a local market.Of all his qualifications for leadership of GraceKennedy & Co., Ltd., Carlton Alexander is remembered by Boerries Terfloth for ‘his open mind’, constantly receptive to information and ideas. Again, in reference to Terfloth & Co.:

Laws change, So do governments, economic conditions, the weather, freight rates, interest rates, health regulations, production techniques, consumer tastes….

Domestic traders have to contend with what’s going on in one country. International traders like ourselves have to cope with those changes multiplied by hundreds….

By definition we trade and between foreign markets. ‘Foreign’ implies differences – in language, culture, religion, customs, traditions, and business practices, as well as actual laws and regulations.

Constantly open minds, eyes, and ears help to keep the world trader away from the wrong end of the equation:

Even 1 Minor Error x Great Distance = Big Expense + Serious Problems.

Nonetheless, with all the advantages of accumulated wisdom, helpful association, and present commitment to develop as a world trader, GraceKennedy & Co., Ltd. will have to be wary of the potholes on the road to this goal. There have been many occasions on which the public media have told us of trade missions sent abroad returning with orders for millions of dollars worth of Jamaican products – orders we have accepted but are unable to fulfil. That is no way to go. We have to take care to ensure that we can obtain the goods before we undertake the order to supply them, and to distinguish between a specific, one-time request and a request for regular and dependable delivery. Regularity of supply requires absolute assurance of the continuing availability of the promised

quantity and quality of the commodity to be supplied. Future trade cannot be built on present surplus.

There is sometimes too great a distance between the boardroom on the managerial office and the field of factory floor. It is wasteful of resources not to reap ideas and suggestions from every available source; and it is restrictive of the market not to recognize the needs of the vast majority and the circumstances in which they live. GraceKennedy & Co., Ltd., built originally on flour and salt-fish and now the provider of chicken necks and backs, know this – and yet, though television is now within the view of most, how often do the demonstrators of ‘Creative Cooking’ show us the uses of a coal-pot or the varieties of one-pot meal which coal-pot users might be able to afford and prepare?

The hampering effect of too much bureaucracy provides another pitfall. Perhaps we are encouraged by a morass of rules and regulations to spend too much time exploring how they might be more rapidly and conveniently met or avoided. The more time given to talking about the conduct of business, the less there is for talking business. Consider the valuable time lost and tempers frayed these days in the basic exercise for any merchant of getting cargo off the docks.

These are but a few of the potholes to be avoided en route to 2,000 A. D. when, if all goes as planned, GraceKennedy & Co., Ltd., will be recognized as the world’s new TradingHouse.